Why Hedging?

Long Term Investors

- Reduce portfolio’s volatility during market or stock risky phases

- Better Sharp Ratio

- Reduce tax payment

When To Hedge

We monitor market risk signals from six different areas:

* TA = Technical Analysis

* MA = Money Flow Analysis

* EA = Event Analysis

* PA = Political/Policy Analysis

* FA = Fundamental Analysis

* SA = Sentiment Analysis

How To Hedge

Options, Inverse ETFs, VIX

Hedge = buy insurance

- Sell Covered Calls:

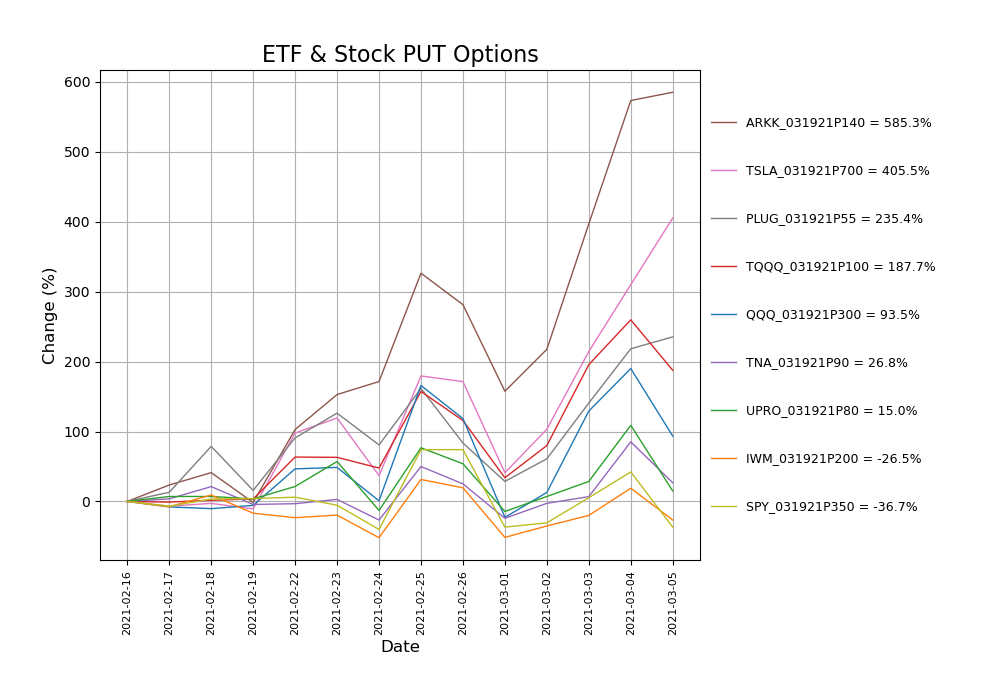

- ETF Puts:SPY, QQQ, IWM Puts, UPRO, TQQQ, TNA Puts, ARKK puts …

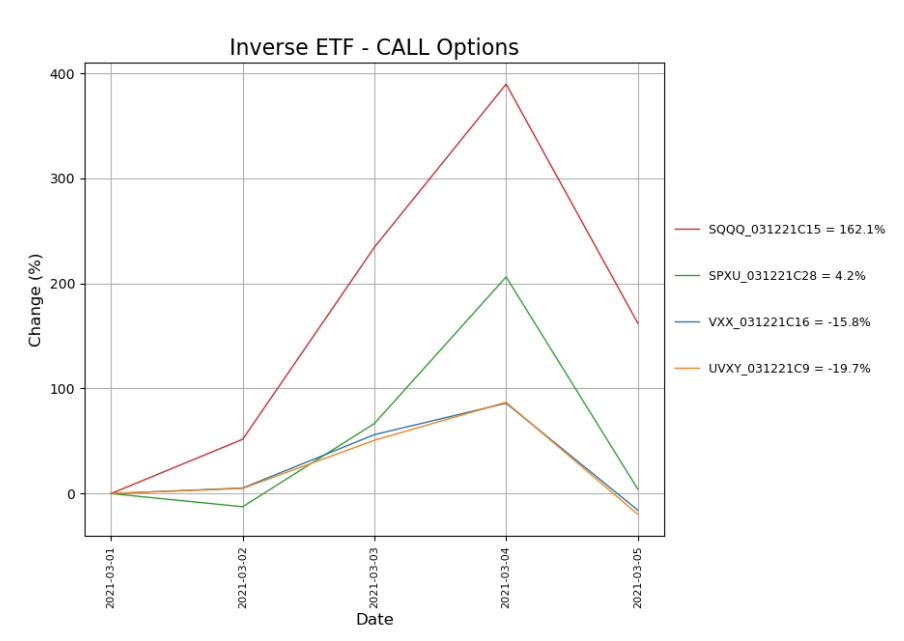

- VIX:VXX, UVXY, VIX, VXX, UVXY Calls

- Inverse ETFs:SPXU, SQQQ, TZA, SPXU, SQQQ, TZA Calls

- Stock Puts:TSLA puts, PLUG puts, …

Hedging with Put Options

Hedging with Call Options

How Much To Hedge

- Simple Hedging: Hedging ratio: 10-1

100k LONG position vs 10k SHORT position

LONG drops 1%, Hedge increases 10%

LONG drops 10%, Hedge increases 100%

we choose hedging targets with high leverages - Delta Hedging (complex hedging): Portfolio sum of all deltas = 0

Hedging: Option Delta

BTO Calls: Positive Delta; BTO Puts: Negative Delta

STO Calls: Negative Delta; STO Puts: Positive Delta

Options Pricing

s=stock price of the XYZ stock

p=option price of the XYZ stock

p=f(s), p is a function of s.f(s) is hard to figure out

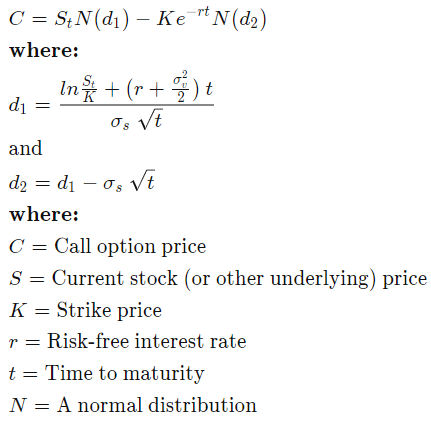

Black Scholes Model

Black Scholes Merton Model (BSM Model)

Scholes and Merton won 1997 Nobel Prize

(Black passed away two years before 1997)

The entire option market is built on BSM Model.

Now the option market is bigger than the stock market.

BSM Formula

The Black-Scholes model makes certain assumptions:

* The option is European and can only be exercised at expiration.

* No dividends are paid out during the life of the option.

* Markets are efficient (i.e., market movements cannot be predicted).

* There are no transaction costs in buying the option.

* The risk-free rate and volatility of the underlying are known and constant.

* The returns on the underlying asset are normally distributed

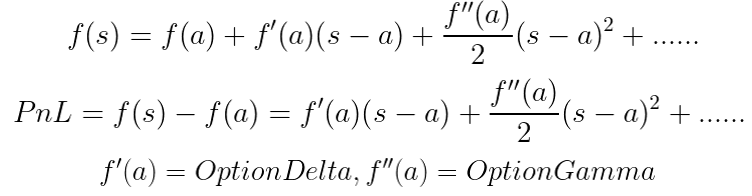

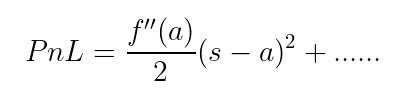

Options Taylor Formula

Taylor series:

Delta neutral strategy: portfolio delta=0

Regardless if stock price goes up (s>a) or stock price goes down (s<a), the option price is always up if gamma is positive, or the option price is always down if gamma is negative!